buying a rolex watch bring outside tax refund | rolex duty free refund buying a rolex watch bring outside tax refund I wanted to share my customs experience bringing my first Rolex in from Europe. I purchased the watch on 07/2022 at the Amsterdam Airport. Now, note that when you request a VAT refund . $15.99

0 · should you pay taxes on watches

1 · rolex watch forum

2 · rolex tax refund

3 · rolex purchased overseas

4 · rolex purchased by customs

5 · rolex duty free refund

6 · rolex duty free

7 · buy rolex after vat refund

Amahagan World Malt Edition Peated: 47.0 % Vol. 700 ml: 85.00: Amahagan World Malt Edition No. 2: 47.0 % Vol. 700 ml: 2019: 85.25: Amahagan World Malt : 47.0 % .

Generally there is a counter/office at the airport where you can bring your documentation and get a refund (be sure to give yourself extra time, there may be a wait). In some locations stores may advertise that they sell “tax-free” if you show a foreign passport; .

If you buy outside and claim your tax back at the airport, the refund is about 13.8% (not the 16.8% reduction at duty free). The retailer claims an 'admin fee'* of about 3% so the .

should you pay taxes on watches

rolex watch forum

There’s a value added tax (VAT) that gets refunded to tourists leaving the EU with the item, provided you file the paperwork and go through EU customs on departure. . Stores outside the mall will refund and discount the 10% tax at point of sale. If you purchase something in the mall, there's separate tax refund counter you must visit inside the .I wanted to share my customs experience bringing my first Rolex in from Europe. I purchased the watch on 07/2022 at the Amsterdam Airport. Now, note that when you request a VAT refund . Carrying more than one Rolex watch from outside of the country is a trademark violation of Rolex U.S.A. and they can be impounded. Additionally, bringing in a fake Rolex from overseas is also a trademark violation and will be .

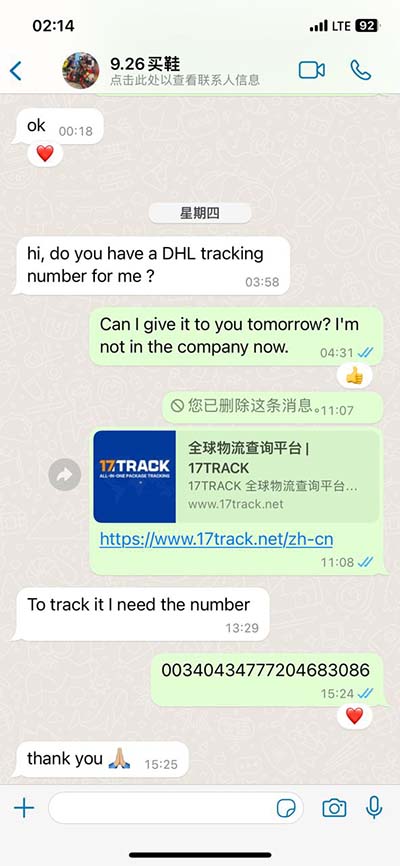

I'll be purchasing a luxury watch while in Europe and bringing it back from Europe to the United States. The total cost will exceed K. I've read about the need to provide my passport at . Depending on the store you purchase your watch(es) from, they can either charge you the price of the watch minus the consumption tax or charge the full price and send you to . I look at the price + sales tax in the US before I buy while on vacation. While in the Caribbean I always get a good deal or I walk away. It can also depend on the exemptions you . Generally there is a counter/office at the airport where you can bring your documentation and get a refund (be sure to give yourself extra time, there may be a wait). In some locations stores may advertise that they sell “tax-free” if you show a foreign passport; they essentially do the paperwork for you.

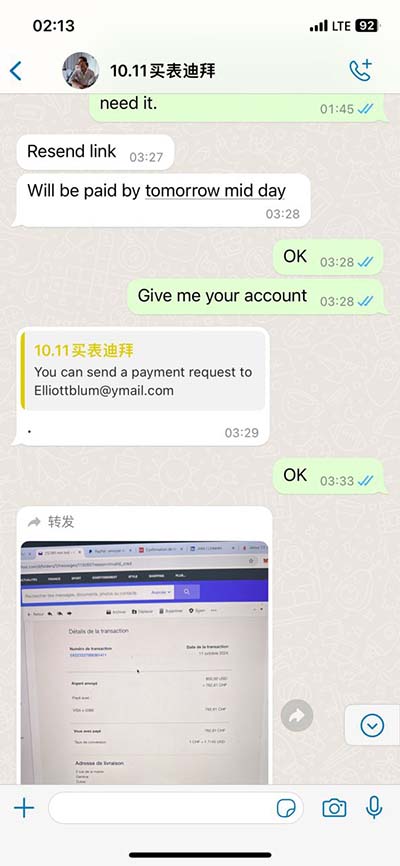

If you buy outside and claim your tax back at the airport, the refund is about 13.8% (not the 16.8% reduction at duty free). The retailer claims an 'admin fee'* of about 3% so the actual refund is a bit less than the saving at duty free. Depending on the store you purchase your watch(es) from, they can either charge you the price of the watch minus the consumption tax or charge the full price and send you to a customer service counter to get an immediate cash refund.There’s a value added tax (VAT) that gets refunded to tourists leaving the EU with the item, provided you file the paperwork and go through EU customs on departure. Depending on the country you buy from that refund varies, you can check to get an idea on the approximate percentage. https://www.globalblue.com/tax-free-shopping/

I paid about 3% duty returning home when I bought a watch in Italy. But with VAT refund it was less expensive than buying in US. PS: if you want to play by the book and don’t use the watch, just request the VAT refund, declare the watch, get the 0 exemption and then pay taxes on the reminder. It might actually be less than what you would pay in the country where you are buying. Stores outside the mall will refund and discount the 10% tax at point of sale. If you purchase something in the mall, there's separate tax refund counter you must visit inside the mall on the same day of purchase for the cash refund.

I wanted to share my customs experience bringing my first Rolex in from Europe. I purchased the watch on 07/2022 at the Amsterdam Airport. Now, note that when you request a VAT refund you give your passport, which is registered in the system. Carrying more than one Rolex watch from outside of the country is a trademark violation of Rolex U.S.A. and they can be impounded. Additionally, bringing in a fake Rolex from overseas is also a trademark violation and will be seized. I'll be purchasing a luxury watch while in Europe and bringing it back from Europe to the United States. The total cost will exceed K. I've read about the need to provide my passport at time of purchase to avoid the VAT. I plan to bring the watch back in it's original pouch through my carry on. Generally there is a counter/office at the airport where you can bring your documentation and get a refund (be sure to give yourself extra time, there may be a wait). In some locations stores may advertise that they sell “tax-free” if you show a foreign passport; they essentially do the paperwork for you.

rolex tax refund

If you buy outside and claim your tax back at the airport, the refund is about 13.8% (not the 16.8% reduction at duty free). The retailer claims an 'admin fee'* of about 3% so the actual refund is a bit less than the saving at duty free. Depending on the store you purchase your watch(es) from, they can either charge you the price of the watch minus the consumption tax or charge the full price and send you to a customer service counter to get an immediate cash refund.There’s a value added tax (VAT) that gets refunded to tourists leaving the EU with the item, provided you file the paperwork and go through EU customs on departure. Depending on the country you buy from that refund varies, you can check to get an idea on the approximate percentage. https://www.globalblue.com/tax-free-shopping/ I paid about 3% duty returning home when I bought a watch in Italy. But with VAT refund it was less expensive than buying in US.

PS: if you want to play by the book and don’t use the watch, just request the VAT refund, declare the watch, get the 0 exemption and then pay taxes on the reminder. It might actually be less than what you would pay in the country where you are buying. Stores outside the mall will refund and discount the 10% tax at point of sale. If you purchase something in the mall, there's separate tax refund counter you must visit inside the mall on the same day of purchase for the cash refund.

I wanted to share my customs experience bringing my first Rolex in from Europe. I purchased the watch on 07/2022 at the Amsterdam Airport. Now, note that when you request a VAT refund you give your passport, which is registered in the system.

Carrying more than one Rolex watch from outside of the country is a trademark violation of Rolex U.S.A. and they can be impounded. Additionally, bringing in a fake Rolex from overseas is also a trademark violation and will be seized.

rolex purchased overseas

rolex purchased by customs

rolex duty free refund

rolex duty free

On The Launch Pad: Omega Speedmaster Hodinkee 10th Anniversary (311.32.40.30.06.001) Yes, this is our own Speedmaster .

buying a rolex watch bring outside tax refund|rolex duty free refund